Stepped vs Level Insurance Premiums

When taking out insurance, there are generally two ways you can pay your premium.

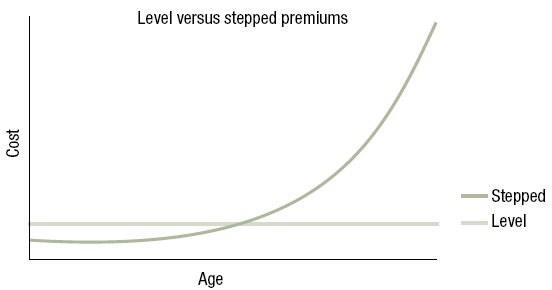

- Stepped Premium – your premium increases every year with your age.

- Level Premium – your premium generally does not change and is based on your age when the policy commences.

While stepped premiums are usually lower in the early years, level premiums can be a more cost-effective option if you retain the insurance over a longer period. If insurance cover is only required for a short time frame, a stepped premium may be more appropriate and cost-effective.

Level Premiums

Level premiums are higher than stepped premiums at the start (see graph below). However, as stepped premiums increase, level premiums can end up cheaper – often at the stage in life when you need the cover most. The premium savings in later years can make up for the additional payments in earlier years – saving you money over the life of the policy.

Combining stepped and level premiums

Just as you can opt for a combination of fixed and variable rate home loans, you may want to take out part of your insurance using stepped premiums and use level premiums for the rest. This way, the premium in the earlier years will be lower than if you opt entirely for level premiums.

Over time, you can then reduce your stepped premium cover as you build up more assets and potentially need less insurance. As a result, you could end up paying level premiums on most (if not all) of your insurance in the later years, and benefit from the lower premium costs associated with level premiums at that time.

Factors to be aware of:

- The earlier you ‘lock-in’ the level premium, the greater the potential long-term savings. This is because level premiums are generally lower if you take out the insurance at a younger age. However, as you approach age 65, the difference between the two premium structures diminishes for new policies.

- Level premiums can make budgeting easier, because you know in advance exactly what your insurance is going to cost.

- The maximum age you can start a policy with level premiums is generally lower than for stepped premiums.

Tax Deductibility of Insurance Premiums

The premiums payable on income protection policies are generally tax deductible; however, the income payments received will be taxed at the applicable tax rate.

Generally, death, trauma and TPD insurance premiums paid are not tax deductible, but when a claim is paid the benefits are not subject to tax.